CEOs beware!

When companies suffer reputation damage, what becomes of the CEO? And what can CEOs learn?

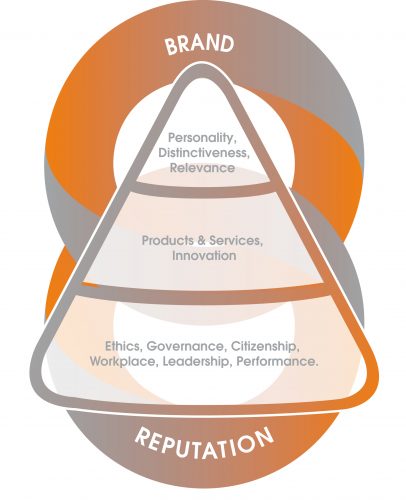

Companies spend significant sums on understanding, building and protecting corporate brand and reputation but what of the CEOs leading these companies? Evidence suggests that corporate and CEO reputations are intrinsically linked but CEOs don’t always enjoy the same level of support and protection in times of reputation crisis.

Looking back over the biggest corporate scandals of recent years a clear picture emerges. Corporations, if they act swiftly to correct the cause of a scandal, can recover their reputations and rebuild lost value. For the CEOs at the helm at the time of the scandal, the outlook isn’t always so good.

Below we’ve listed some of the biggest reputation crises and looked at what became of the companies and the CEOs in question. We looked to see if there’s anything CEOs can do to protect their personal reputation when the company they lead suffers a crisis or a scandal.

What we found is that the most important thing a CEO can do is to ensure they listen to informed, critical voices. In nearly all the crises we looked at, there were early warning signs usually coming from employees or other key stakeholders. In that regard, there are distinct similarities to managing corporate reputation: the need to understand the perceptions, expectations and needs of people who can influence your business and your personal standing.

Let’s start with the biggest corporate failure ever, Enron. We all know the fate of the company: it imploded after an accounting scandal was revealed. 20,000 people lost their jobs and the company closed.

Kenneth Lay, CEO at the time, was later indicted on 11 counts of securities fraud, wire fraud and making false statements. In May 2006 he was found guilty. Just two months later he died of a heart attack, caused, many believe, by the stress of the trial and the outcome. Surely the biggest personal price anyone could pay for a corporate failure.

In the post-failure analysis, it was revealed that there were employees questioning accounting practices and culture at Enron but their concerns fell on deaf ears; questionable behaviour had become normalised, dangerous cultural norms had developed. There’s a lesson for CEOs here about ensuring they hear voices of dissent – having sight of key data revealing both good and bad.

There’s also the other issue of cultures that develop in times of great success. Strong growth can breed arrogance and the misplaced belief that if a company is delivering its numbers, it must be doing everything else well. It takes a CEO with a level of humilityto recognise that success doesn’t always breed success. CEOs that survive – indeed can thrive – post crises are those that cultivated a humble mindset through being open to wise advice, horizon scanning data, avoiding the “good news echo chamber”.

Another almighty fall was that of RBS. A blog about disgraced CEOs wouldn’t be complete without a mention of Fred ‘the shred’ Goodwin. It’s fair to say that ten years after the crisis that bought RBS to its knees, Fred’s reputation remains in tatters. RBS itself has somewhat recovered, reporting pre-tax profits this year of £3 billion with its first dividend pay-out in a decade. Fred’s reputation suffered badly as he was held directly accountable for the decisions that led to the collapse of the bank, which included the doomed takeover of ABN Amro.

It’s interesting that RBS is another company that had an almighty fall following a prolonged period of spectacular growth. That growth seemingly breeding a culture of arrogance leading to hubris on the part of its CEO. It takes a high level of emotional intelligenceto remain humble and open to challenge when your company is delivering growth. Few manage it. Leadership is not about one individual alone, except perhaps in the sense that that individual needs to be able to gather and motivate a team that is clear sighted about the risks as well as the rewards.

Our top 7:

Paul Flowers & The Co-op Bank

What happened?

- In the first half of 2013 the Co-operative Bank lost £600m and then discovered a £1.5bn hole in the banks finances. Its banking arm was hit by compensation for PPI mis-selling, bad loan losses and a write-down of its IT system. The acquisition of Britannia in 2012 caused a £257mil loss. The FSA later described “a catalogue of bad decisions by the board”.

What was Paul Flowers’ role in the event?

- Reports claimed that rather than overseeing the activities of his Executives, Flowers enjoyed socialising, networking and helping the Labour Party.

- While he did not bring down Co-op bank himself, his inexperience and incompetence was reported as doing serious damage. Media reported “at a time when the bank needed the guidance of a strong chairman, they had the uneducated, uninterested Flowers.”

What was the personal impact?

- Following intense criticism, Paul Flowers stepped down and was replaced in June 2013.

- In November 2013 a video clip was handed to the Mail on Sunday showing him agreeing to buy class A drugs and in April 2014 he was charged for possession receiving a £400.00fine. Following the video clip being released Flowers was suspended indefinitely by the Methodist Church in November 2013.

- In 2016 he was pictured by the Mirror after a ‘4-day bender’ and was dubbed ‘The Crystal Methodist”.

- In 2018 he was banned from the financial services industry by the FCA for having used his work email for sexually explicit messages and discussing illegal drugs. He had also used his work mobile phone to call premium chat lines.

- His lack of knowledge of banking was exposed, he was unable to say or guess how much the bank had lent, and when asked what the Co-op assets were, he guessed £3bn, with the true figure being £47bn.

Where is he now?

- Banned by the FCA from working in finance; retired.

Tony Hayward & BP

What happened?

- Deepwater Horizon oil spill in 2010 caused 11 deaths and an oil leak onto the sea floor of 50,000+ barrels a day, creating an environmental catastrophe.

What was his role in the event?

- CEO of BP at the time.

- US District Judge Carl Barbier attributed 67% of the fault to BP, saying their conduct in drilling and safety was “reckless”.

- Reports later emerged of a series of safety warnings that hadn’t been heeded.

What was the personal impact?

- He was publicly criticised by President Obama and his chief of staff for comments made as the disaster unfolded and for participating in the JP Morgan Asset Management Round the Island yacht race. Obama’s chief of staff claimed it was another in a ‘long line of PR gaffes’ whilst the oil spill continued.

- His award of an honorary degree from Robert Gordan university was described as “a very serious error of judgement” by Friends of the Earth Scotland.

- Announced he would leave BP on the 27thJune 2010.

- Spent three years ‘out in the cold’.

Where is he now?

- Appointed chairman of CompactGTL, a UK based gas to liquids company in March 2013.

- Non-executive Chairman at Glencore, a multinational commodity trading and mining company.

- Was appointed Non-executive director of General Energy on 2ndJune 2011… then as Executive Director and CEO on 21stNovember 2011. Left June 2017.

Fred Goodwin & RBS

What happened?

- RBS suffered losses of £24.1 billion, the biggest loss in corporate history. £16.8 billion of the losses were attributed to write-downs relating to the takeover of ABN Amro.

What was his role in the event?

- Goodwin was CEO at the time, and it was his strategy of aggressive expansion, primarily through acquisition, that reportedly caused the downfall of RBS.

- He had previously undertaken more than 20 takeovers at the bank.

- Resigned in early 2009.

What was the personal impact?

- March 2009 his house and car in Edinburgh were vandalised.

- The Guardian City editor Julia Finch labelled him as one of the 25 people at the heart of the financial crisis.

- He was stripped of his knighthood in 2012.

- Daily Mail claimed he was ‘regarded by analysts as one of the most arrogant figures in the City’.

- Goodwin received a notional fund of £8million which was doubled to £16 million as his pension entitlement.

- The size of his pension entitlement drew criticism from Gordon Brown, John Prescott and Vince Cable. Gordon Brown declared that a “very substantial part of his pension should be returned”. John Prescott called on the government to withdraw his pension, telling Goodwin to “sue if you dare”.

- Vince Cable said he should be entitled to a compassionate pay-out of £27,000 a year and if he does not like that, he could sue… he added Goodwin “obviously has no sense of shame.”

- Goodwin later agreed to forfeit half of his pension.

- FSA report blamed him for “multiple poor decisions” during his stewardship of RBS.

Where is he now?

- Receiving annual pension package, occasional consultancy work.

Kenneth Lay & ENRON

What happened?

- The 2000 Enron scandal was the largest global bankruptcy to date. (Bankrupt 2001). 20,000 people lost their jobs and in many cases their life savings. Share price reduced from $90 to pennies.

- The company was found to have systematically overstated earnings dating back to 1997 whilst concealing debts so they didn’t show up on the company’s accounts.

What was his role in the event?

- As founder, CEO and Chairman he approved of actions of senior staff however did not always inquire into the details – accused of ‘turning a blind eye’.

- Lay later claimed he was a victim rather than the villain.

What was the personal impact?

- Was indicted by the Grand Jury in Texas for his role in the failure, was charged with 11 counts of securities fraud, wire fraud, and making false and misleading statements.

- In May 2006 he was found guilty on six counts of conspiracy and fraud by the Grand Jury. In a separate bench trial, he was found guilty of four additional counts of fraud and making false statements.

Where is he now?

- Died on July 5th, 2006 with the autopsy indicating a heart attack as cause of death.

Harvey Weinstein & Weinstein Productions

What happened?

- Harvey Weinstein was dismissed in October 2017 after 100+ people came forward to accuse him of sexual harassment, assault or rape.

- In the following days/ weeks companies such as Apple, Amazon and Lexus ended their collaborations with The Weinstein Company (TWC).

- Company declared bankruptcy in February 2018.

- Dropped by defence lawyer October 2017 after failing to get the charges dismissed.

What was the personal impact?

- May 25th, 2018 he was charged by New York prosecutors with ‘rape, criminal sex act, sex abuse and sexual misconduct for incidents involving two separate women.’

- January 2018 Weinstein’s PA Sandeep Rehal sued both Weinstein brothers and TWC for discrimination and harassment alleging much of her work involved ‘catering to Harvey’s sexual appetites and activities’, including working whilst naked.

- These allegations prompted the #MeToo hashtag, a viral hashtag which encouraged victims of sexual harassment and assault to speak about their experience. Many US celebrities and politicians were exposed through this and it became known as ‘The Weinstein Effect’.

- Condemned by top politicians globally – including the Obamas and Clintons: President Macron of France initiated the revocation of Weinstein’s Légion d’honneur title.

- UK labour members of parliament requested the revocation of his Commander of the Order of the British Empire title.

Where is he now?

- Awaiting trial on two counts of rape.

- Recently paid out a $44 million settled for other indecent acts.

Mike Jeffries & Abercrombie & Fitch

What happened?

- Forced to step down in 2014 amid mass criticism of company’s performance and 11 straight quarters of negative growth.

- Shares jumped 8% after his removal as CEO was announced… the biggest 1-day gain in 9months.

What was his role in the event?

- CEO 1993 – 2014.

- During his time as CEO he offended large numbers of groups including the feminist movement with comments related to the looks of his employees and customers, such as reportedly commenting how he only wants A&F marketed to ‘cool, good looking people’ and doesn’t want ‘overweight’ or ‘unattractive people’ wearing the brand.

- He took annual compensation packages as high as $71.8 million even when growth stalled.

- Refused to lower prices during the retail recession even when stores posted losses for 17 consecutive months.

What was the personal impact?

- Ridiculed online and in the press.

- Forced to give up his hold on the company he founded.

- Forced to resign.

Where is he now?

- Retired in 2014.

Stephen Elop and NOKIA

What happened?

- His ‘Burning Platform’ memo, which likened Nokia’s 2010 situation in the smartphone market to a person standing on a burning oil platform was seen as an act of misjudgement by the board with Chairman Jorma Ollila giving bitter feedback at a board meeting.

- During his 4-year tenure as CEO Nokia’s stock price dropped 62%, their mobile phone market-share halved, their smartphone market share fell from 33% to 3%. Company suffered €4.9 billion losses.

What was the personal impact?

- Was dubbed the ‘Elop effect’ by former Bokie Executive Tomi Ahonen -he said ‘it combines the Ratner effect with the Osborne effect’ meaning both publicly attacking one’s own products and promising a successor to a current product too long before its available.

- Forced to step down in 2014

- He received 18.8million€ bonus after Nokia sold its phone business to Microsoft with controversy when it was revealed his contract had been revised the same day as the deal was announced.

- Prime Minister of Finland Jyrki Katainen told Finnish television that the payoff was “outrageous.”

- Was rumoured that he was a Trojan Horse for Microsoft, in that he was planted by Microsoft in Nokia to drive share price down with the aim of acquisition.

- While speaking at the Mobile World Conference a member of the audience shouted out “Are you a Trojan Horse?” His reply, “I have only ever worked on behalf of and for the benefit of Nokia shareholders while at Nokia” adding that “all fundamental business and strategy decisions were made with the support and approval of the Nokia board of directors.”

Where is he now?

- In 2014 he returned to Microsoft as Executive Vice President of the Microsoft Devices Group. Laid off in 2015 as part of massive job cuts. 2016 he became Group Executive Technology, innovation and Strategy at Telstra.

- Forced out in executive reshuffle in 2018.