CEO Reputation – how to survive a crisis

Companies mostly recover from reputation crises, CEOs rarely do.

If you are a CEO or part of the executive team at a company, and you value your job and your personal reputation, then you would be wise to take an active interest in your company’s reputation.

Looking back over major reputation crises a consistent picture emerges: a crisis hits; value is destroyed; the CEO is fired; the company moves on and reputation recovery begins.

CEOs rarely survive a reputation crisis. Think of Gerald Ratner of Ratners, Tony Hayward of BP, Paul Flowers of Co-op Bank, Martin Winterkorn of VW Group, Maria das Graças Silva Foster of Petrobras, Sepp Blatter at FIFA and most recently, Travis Kalanick of Uber. And there are many more examples.

These CEOs were fired for two reasons, first, they were blamed for the issue that led to the reputation damage and second, they didn’t respond well in the eye of the crisis; they got the tone wrong and they were punished for it.

There are strategies to avoid both scenarios, or at least reduce both the risk and the impact of a crisis so that keeping the CEO is viewed as part of the solution rather than part of the problem.

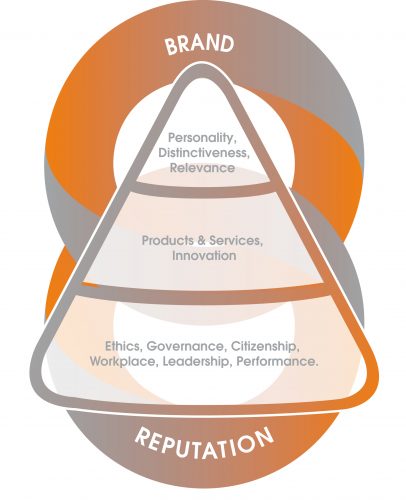

To reduce the risk of a crisis requires effective reputation management and executive reporting. And by reputation management I mean having a regular pro-active dialogue with your key stakeholders so that you can keep ahead of any looming issues, assess necessary trade-offs and respond where necessary.

BP is a good example of where this approach could have helped avoid a crisis. In the analysis of the 2010 Deepwater Horizon oil spill it was found that BP had been given many warnings by the US regulator about safety issues on the platform. Not only that, employees had also raised concerns. The warning signs were there from two different groups of stakeholders but the executive team at BP either didn’t hear or didn’t heed those warnings. Is it any wonder the CEO had to go?

As a CEO, are you confident that you have the engagement and reporting mechanisms in place to ensure you hear the concerns of your key stakeholders in time to act upon them?

The second strategy is about how you reduce the impact of a crisis and that’s about how you respond. It is critical to quickly read the mood and get the tone of your response right.

Again, looking at the BP case, who couldn’t help but baulk at the juxtaposition of the image of President Obama with his sleeves rolled-up, shoveling oil waste on a beach in Louisiana (looking like part of the solution) against the image taken at the same time of BP CEO Tony Hayward looking tanned and relaxed, sitting on the back of a yacht thousands of miles away (looking like part of the problem).

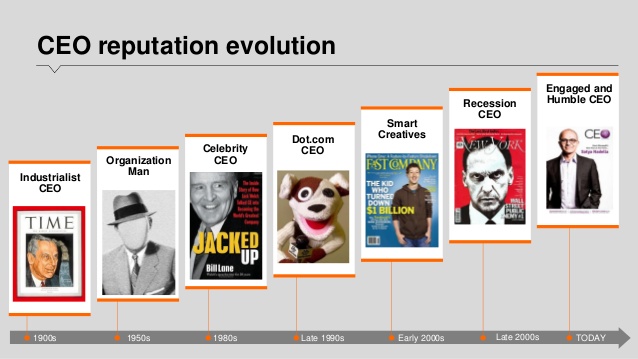

When a crisis hits, the CEO must look like part of the solution. If it’s an operational crisis of some sort, you must get to the scene and look like you are taking control. The image and the tone are equally important. It helps to be guided by experts in coaching CEOs through crises – it can be challenging and daunting to go it alone. But if you do, remember we are in the age of the ‘humble and engaged’ CEO: show humility, empathy and poise. Something President Obama has truly mastered.

In summary, reduce the risk and the impact of a crisis by first having effective reputation management strategies in place and second, by ensuring you are adequately coached in how to respond to a crisis.

Here at Tovera we can help you with the first. Our friends at Alder can help you with the second.

…………………………

Spencer Fox is a reputation and corporate brand expert. He has advised companies such as AstraZeneca, ITV, L’Oréal and Tesco. He is a founding partner of Tovera Consulting – a brand and reputation research, strategy and advice consultancy. Tovera helps companies build both strong brands and reputations as both are critical to long-term business survival.