Do you know what your stakeholders are thinking?

When a company is making a strategic shift, like breaking into a new market or repositioning in an existing market, bringing its stakeholders with it is critical to its success. Those that choose to ignore this rule risk destroying value.

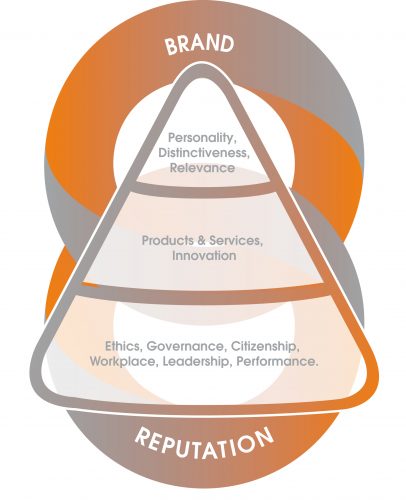

A company listed in the UK, on average, is valued at over three times its fixed/tangible assets. Around two thirds of a company’s value is held in intangible assets, most often attributed to brand and goodwill (reputation). When you think about that it’s easy to understand why companies would want to protect brand and reputation, as it is here that most company value is held.

However, it is this intangible value that is most susceptible to risk. Brand damage and resulting value destruction usually follow either an operational or a reputational issue.

Research by Schillings, which supports our experience here at Tovera, finds that the reputational issues which result in the greatest value destruction are those where the expectations stakeholders hold towards a company are found to be out of sync with reality. In this scenario stakeholders are ‘spooked’ – what they believed and expected of a company is suddenly called in to question. The outcome is that they withdraw their support. Those that were once solid advocates become quiet, those that were once neutral can shift to noisy detractors.

And without the support of a range of stakeholders, businesses struggle.

An obvious example is what happened to Tesco between 2011 and 2015. In 2010 Tesco reported its biggest ever profit, the following year its biggest loss. What became apparent very early on was that Tesco suffered from a lack of stakeholder support. No one was willing to speak in support of Tesco and many only too willing to speak against. It arguably made the recovery from its reputational crises that much harder, bringing added scrutiny and exposure to its issues at a time when it needed space to recover. This lack of stakeholder support is something that Tesco has since acknowledged and has made significant investment in correcting. It’s now OK to love Tesco again but it took Tesco the best part of 8 years to recover.*

Contrast that with the crisis faced by AstraZeneca in back in 2014. Here was a pharma company (at that time) with a weak pipeline, back in the days before Covid when big pharma was considered the bad guy with many detractors. Pfizer made an aggressive takeover bid for AstraZeneca which many in the business press reported as a fait accompli. AstraZeneca was able to mobilise a small army of supporters in government, regulators, NGOs and business to help them fight off the take-over attempt. In the face of such strong support for AZ, Pfizer withdrew its bid. AstraZeneca then had breathing space to regroup, refocus and develop into the strong position it is in today**.

If we conclude that stakeholder support is a crucial component of business success, then it follows that when a company looks to break into a new market or reposition within an existing market it must work to bring stakeholders on the journey.

The question to ask is – do you really know what’s in those stakeholders’ hearts and minds?

In planning for success, the understanding of what stakeholders truly perceive and expect of a company, and the strength and basis for their support, is essential input for engagement and communications strategies to ensure they remain on board, ready to continue in support of the business in good times and bad.

* Tovera partners Spencer Fox and Ann Binnie proudly supported Tesco on its reputation recovery work, providing the stakeholder analysis and insights that went on to define Tesco’s ‘Using our scale for good’ strategy –which was central to its reputation recovery.

**We also worked with AstraZeneca back in 2012/3 helping them map ‘global opinion leaders’ – those with the ability to shape the pharma sector. Our work informed the corporate affairs and communications strategies which built a base of support prior to the attempted takeover by Pfizer.