Uber’s reputation under attack: what Uber could learn from Tesco

Uber’s reputation is taking a pounding. We’ve all seen the avalanche of negative news stories of late: accusations of sexism in the workplace, using covert software to ‘grey-ball’ regulators, the CEO abusing an Uber driver, and the long running debate on whether Uber’s drivers should have employee rights, to name just a few.

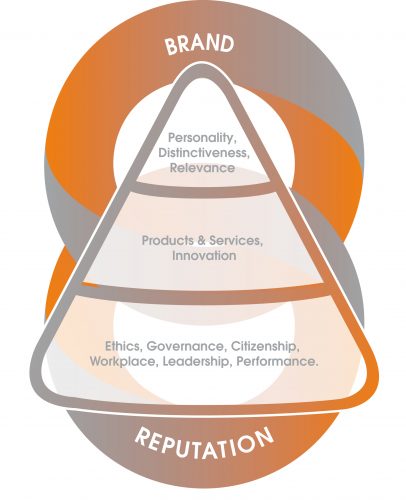

The question is do these negative events, which are essentially linked to corporate reputation and not the customer brand experience, directly affect customer preference and therefore, revenues?

The short-term answer is probably not. Customers – whilst happy to ‘virtue signal’ on their social media accounts – are happy to trade their values for convenience. And this benefits Uber. Customers love Uber, it’s perceived to be a cool brand with a great customer experience: it’s cheap, convenient and easy to use with an excellent app’ and underlying technology.

It really would take a catastrophic event for a company with such a great product and brand experience to lose a mass of customers overnight due to a reputational issue.

That said, whilst aforementioned negative events won’t immediately distract customers, they would be concerning to other stakeholders of Uber: their drivers, government and regulators, influencers and other thought leaders. It is when, collectively, these stakeholders begin to feel uneasy about a company that they start to withdraw their support and things can get difficult.

Without stakeholder support it could become increasingly difficult for Uber to go freely about its business. It risks government and regulatory pressures (and even intervention), and continuing attacks from influencers and key opinion leaders will ebb away at goodwill giving space to competitors. Without addressing the negativity, it can gather pace towards a tipping point where customers also begin to feel uneasy about associating themselves with the brand and so seek out alternatives.

So whilst all this negative news might not be having an immediate affect on customer preference, it is almost certainly building up problems for the future.

Uber could learn from Tesco. An entirely different company and proposition, obviously, but Tesco’s attitude back in the early 2000’s was similar to that of Uber today: aggressive expansion, focus on the customer and everyone else can go to hell (my interpretation, not their words).

Tesco grew at a startling rate between 1990 and 2010. It did so by a relentless focus on the customer and their habits. Its success blinded it to the concerns of other stakeholders such as suppliers, opinion leaders and environmental groups. Many of which considered Tesco as aggressive and arrogant.

Things came to a head for Tesco in 2011 when market dynamics began to shift and Tesco found for the first time that it wasn’t ahead of the curve. It may well have only needed a shift in strategy, but after years of neglecting stakeholders, the tide had gone out and Tesco was found to have very little support. In addition, the cumulative effect of negative stories of Tesco as an aggressor had reached the tipping point where customers were beginning to feel uncomfortable about being associated with Tesco. Tesco’s customer loyalty had been slowly eroded. Investors were spooked and in January 2012 following lack-lustre Christmas sales, Tesco lost 18% of its market value.

What followed was a negative scrutiny of every aspect of Tesco’s culture, brand and operation and crises such as horsemeat and accounting malpractice made headline news for weeks at a time. Tesco’s share price continued to fall over the period and today is less than half than at its peak.

It has taken Tesco a huge amount of time, cost and hard work to begin to recover its reputation and brand standing. The recovery has been a massive distraction for the business and one it could have avoided.

What was identified early on in Tesco’s post-crisis analysis was that it simply hadn’t worked hard enough to listen to and engage with its key stakeholders. It hadn’t taken their concerns seriously, it hadn’t engaged in meaningful dialogue.

It has been an expensive and painful experience for Tesco and Uber could do well to learn from Tesco’s experience.

Stakeholder engagement is reputation management 101.

A recent report by law firm Shillings identified that one of the most important criteria for protecting a corporate reputation is regular stakeholder dialogue.

Yet it’s amazing how many large companies – in particular global tech companies – do not have proper, professional stakeholder engagement programmes in place. That is, quality, pro-active dialogue with critical stakeholders that reveals the insight to inform key decisions – and where there are trade-offs – on business, brand, reputation and engagement strategies.

This is at the very core of what we do here at Tovera. Whether it’s corporate brand positioning, reputation management strategy or developing a core purpose, it starts with mapping, engaging and understanding the perceptions and expectations of ALL stakeholders.