Reputation measures of Pharma Companies, should you care?

Pharma RepTrak 2016 – a critique

This week saw the publication of the latest data on pharma reputation amongst the general public from both Reputation Institute (RI) and Edelman. It is concerning to see that their findings are contradictory. What is a pharma reputation manager to make of this?

The studies raise questions around what data can be trusted; whether these surveys are really representative and what should a reputation manager take and apply to their own efforts to build and protect their corporate reputation?

To help answer these questions, I sat in on a webinar hosted by RI where they shared the details of their Pharma RepTrak survey.

Below I’ve summarised my observations of the survey, grouped in to four core areas from which I attempt to extract some insight: Reputation; Brand; Corporate Communications and a general Summary.

Note: this is a critique of the RI survey. I have only viewed the topline of the Edelman survey.

Reputation.

- RI data shows that not much has changed since 2013: at a global level the various measures of pharma reputation that RI reports have remained pretty constant between 2013 and 2016

- RI states that the reputation of the “global pharma industry remains average overall”

- But with a small improvement in the global measure observed this year, “trending up” according to RI who suggest that global pharma reputation is on an improving trend

- However, RI also reports that the public perceives pharma as “a sea of sameness” with no single company standing out in its study (although Novo Nordisk and Bayer both singled out for praise by RI for achieving the highest scores across RI’s reputation dimensions)

The Edelman Trust Barometer – by contrast – showed that trust in the pharma industry has decreased in 16 countries — including the U.S. — according to its 2016 study, which surveyed more than 33,000 people in 28 countries. The RI study is smaller both in number of people surveyed and the number of countries covered, but even at a country level – where the findings should be more comparable – there are differences in results.

The differences can be explained in part by the methodology RI deploys in its study. RI measures just 14 companies in 15 countries and then takes the average of those measures to get its ‘global pharma reputation score’.

Also, whilst the 23,000 ratings RI collects sounds impressive, it only equates to 100 ratings per company per market. (For example, just c.100 people in the entire USA rated each of the 14 companies in this study.) So whilst the global measures are robust, company level scores at country level should be viewed with caution. The small sample and high variance means the scores are best viewed as directional.

Finally, the companies selected to be included in the RI study must pass a familiarity threshold and, “have a strong reputation in their home market”. So the RI study is skewed at the outset towards companies that already have relatively good reputations. This might explain why the RI study shows pharma reputations improving whilst the (wider and larger) Edelman study shows trust in pharma decreasing.

So the global pharma reputation measure RI reports is not representative of the entire pharma industry nor is it truly global. It would probably be better to say that the RI study is of the reputations of big pharma in the biggest pharma markets – which is interesting in itself.

A summary of RI’s Pharma RepTrak Results:

- Scores: There is very little separating the highest to the lowest reputation scores of the 14 companies at a global level. (Five of the companies measured have a score within 1 point of each other with a variance of +/- 1 point, meaning the scores should be viewed as the same)

- Bayer stands out as the only company achieving a ‘strong’ reputation score at an aggregate level. All other companies achieve ‘average’ scores

- The familiarity measure is positively correlated with the reputation score: the higher the familiarity, the higher the reputation score

- High levels of ‘neutral’ and ‘don’t know’ ratings on how the companies are perceived across the seven dimensions of Products, Innovation, Workplace, Governance, Citizenship, Leadership, Performance.

- All seven dimensions found to be positively correlated to a company’s reputation score with measures of products & services; governance and citizenship found to have a marginally stronger relationship to the reputation score.

This study shows that the general public has very little knowledge about individual pharma companies, which is no surprise for an industry that is fundamentally B2B.

What I find interesting is the correlation between RI’s measure of familiarity and its reputation measure. The study shows that the more familiar the public is with a company the higher they rate it on the reputation measurement questions. (In the first page of the survey respondents rate a number of company logos on a 5-point familiarity scale.)

This familiarity measure used at the beginning of the RI survey is what people in brand might recognise as a simple measure of awareness. Actual familiarity drops when it comes to the more detailed questions around the dimensions, with many ‘neutral’ and ‘don’t know’ ratings.

So, there’s low familiarity of how companies perform across RI’s seven dimensions of reputation and there’s a positive correlation between general awareness and a company’s reputation score. These two observations taken together would suggest that those companies with the most familiar corporate brands amongst the public are those that fared best in this study.

Reputation Insight

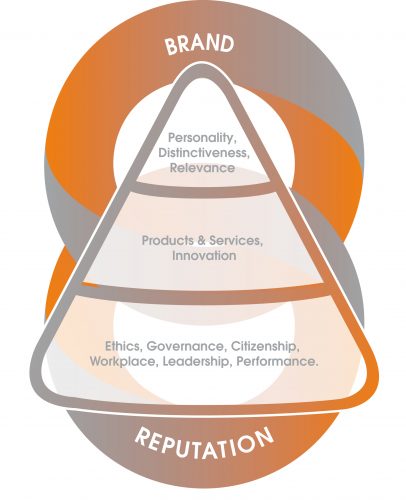

If the key observations are that most pharma companies are perceived to have similar reputations amongst the general public – “a sea of sameness” – and that those companies with higher levels of awareness are more highly regarded, the insight is more about brand than reputation: create more brand awareness and people will perceive you more favourably across reputation dimensions.

However, if your business is B2B, should you be building corporate brand and reputation strategies around insight gleaned from a general public study? Perhaps it shouldn’t be the first group to prioritise, but this survey is perhaps more useful in comparing the differences between the 14 companies measured. Bayer achieving a significantly higher score than every other company in the survey is interesting.

On that basis, it would’ve been good to hear RI’s view on why the general public views Bayer more favourably. And not just refer to Bayer’s measures across RI’s ‘dimensions’ but give some actual context. For instance, could it be because Bayer is a better known/more visible brand than say AstraZeneca is amongst the general public? Which leads neatly on to:

Brand

During the RI webinar the presenter shared some results that were grouped under the title ‘Corporate Brand and Communications’. The problem here is that there wasn’t really anything specifically brand related about this survey or the results that were shared.

The RepTrak reputation model is at the centre of everything RI does. It means that it’s almost impossible for RI to talk about corporate brand with any credibility. Theirs is a fixed methodology which only considers a fixed set of generic reputation attributes. Being generic, it can rarely reveal what makes corporate brands distinct.

Taking account of corporate brand is essential – but attempting to derive insight from reputation measures alone won’t do that. Brand personality, unlike reputation, is not generic.

That’s not to say that corporate brand is not at play in the RI study, it is, but only in the way mentioned earlier, where those companies that the general public is more aware of are those that are generally viewed more favourably on RI’s reputation measures.

Corporate Communications

The grande finale of the presentation was the insight for corporate comms:

“Engage and communicate about who you are as companies and not just what you sell. If you do reputation will go up and support will follow.”

This is such a generic statement that it needs a bit of unpacking: I think what RI is saying here is that: considering that all the dimensions it measures in its study (i.e. the public’s perceptions of a company’s products & service; innovation; workplace; governance; citizenship; leadership and financial performance) are positively correlated with the reputation score, then companies must communicate and engage with the general public on all of these dimensions in order to improve their reputation score.

So as corporate communicators, are you actively communicating a corporate story which references where you stand/what your commitments are across those seven areas?

Summary

There is some interesting stuff in this study but it’s difficult to make sense of it because RI only ever analyses their own data in relation to their own fixed methodology. What this means is their results become something of a self-fulfilling prophecy. What would be useful is if they analysed their data with other measures of success such as the revenues, market share, awards won, etc. of the companies they measure and perhaps with media coverage to help give some context to these results

In conclusion, I still question the value of asking the general public at all. Do other pharma stakeholders take account of their views at all in assessing reputation? Do general public influence the media, regulators, leading academics etc? I don’t think so. Surely it’s the other way around?

If a B2B company really wants to understand its reputation, it should be customers and other critical stakeholders that it engages with and surveys before looking at the general public.

Finally, what is apparent is the influence of corporate brand on perceptions of reputation. In that regard the key insight here is that companies must consider, manage and build both a strong brand and a strong reputation to be successful in the long term – the two should be considered together.

If I were to share two pieces of my own insight, it would be:

- Your corporate reputation is most relevant to your closest stakeholders. For pharma this includes payers/budget holders and other customers, governments and regulators, thinks tanks and academics, key opinion leaders, investors and partners – it’s the perceptions and expectations that these people hold towards your company that is most important to understand.

- Customers and other stakeholders (as well as the general public) are influenced by aspects of both brand and reputation, so the influence of both should be considered in any research and following engagement strategies.

And this, you’ll not be surprised to read, is at the heart of the approach we take at Tovera.